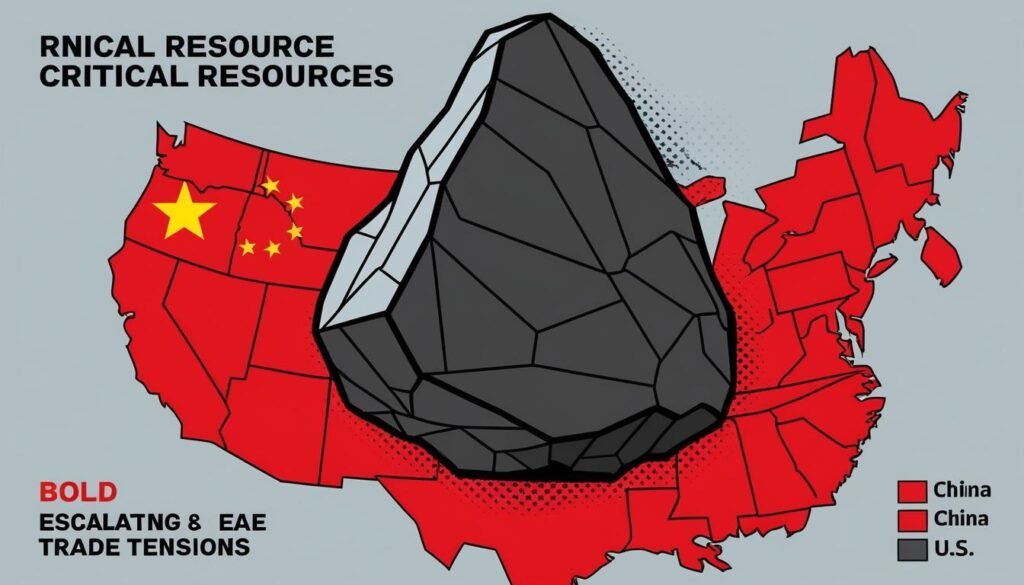

China has implemented a ban on the export of essential minerals to the United States, further straining trade relations and impacting global supply chains.

In a significant development impacting global trade dynamics, China has enacted a ban on the export of crucial minerals—specifically, gallium, germanium, and antimony—to the United States. This measure, implemented on December 3, 2024, follows recent American restrictions on the sale of advanced technology to China and serves to heighten existing trade tensions between the two nations. These minerals are integral components in the manufacturing of semiconductors, as well as essential for various defence and green technology applications. With China leading global production, this ban underscores vulnerabilities within U.S. supply chains and could potentially shrink the U.S. GDP by an estimated $3.4 billion. Jack Lifton, co-chair of the Critical Minerals Institute (CMI), referred to the situation as a “War for Critical Minerals Supplies,” suggesting that control over these resources can be manipulated as a geopolitical weapon.

In response to the escalating situation, the U.S. government is strategising to diversify its mineral sourcing and bolster domestic output to reduce its dependency on China. These intentions are evident in the U.S. Defense Department’s invocation of the Defense Production Act, designed to enhance U.S. production of key minerals including graphite, critical for lithium-ion batteries and other technologies.

Australia is also moving to strengthen its position in the critical minerals sector. The Australian government recently announced an increase of A$400 million to support Iluka Resources Limited in building the country’s first rare earths refinery in Western Australia. This refinery, which is expected to cost a total of A$1.8 billion, will process vital minerals for power generation in renewable energy technologies, including wind turbines and electric vehicles. This initiative is a response to China’s recent export prohibitions that have reignited concerns over reliance on foreign minerals and the nation’s strategic mineral security.

Meanwhile, the military junta of Niger has seized control of the uranium mining operations of French company Orano, aggravating existing supply concerns in the global uranium market. Niger plays a notable role, contributing around 5% to global uranium production. This takeover comes after revisions to foreign company regulations for resource extraction after a coup last July, and it coincides with broader tensions between Niger and France, including the expulsion of French troops from the country. Orano has reported substantial quantities of uranium that remain unexported due to security-related issues.

In Canada, E-One Moli Energy has decided to postpone a $1 billion expansion of its lithium-ion battery factory in British Columbia, a move that could impact approximately 350 jobs. The decision comes amidst declining global demand for electrification projects, highlighting the market fluctuations affecting investment in green technology.

The Critical Minerals Institute also marked a noteworthy organisational shift, appointing Kevin Ernst to its Board of Directors, a move expected to enhance the financial and strategic capabilities of the institute as it navigates the complex and evolving landscape of critical minerals. Alongside this, the CMI is preparing for the International Critical Minerals Expo & CMI Summit IV, scheduled for May 2025 in Pasadena, California, aimed at addressing the multitude of challenges and opportunities within the sector.

Furthermore, a blockchain-based marketplace was launched to facilitate small investors’ ability to purchase tokenized physical uranium, democratizing access to this essential commodity amid rising interest driven by nuclear energy projects. This innovation is being supported by Canadian uranium producer Cameco Corp.

As nations globally contend with urgent mineral needs amid technological advancements, heightened geopolitical tensions exemplified by trade restrictions are catalysing efforts to enhance supply chains, reduce dependencies, and fortify national interests surrounding critical minerals.

In line with these efforts, U.S. President Joe Biden met with several African leaders in Angola to advance the Lobito railway project, which aims to improve transport logistics of critical minerals from the resource-rich regions in Congo and Zambia to Western markets. The $550 million U.S.-backed initiative is expected to play a vital role in countering China’s significant influence in Africa’s mineral sector.

The critical minerals landscape continues to evolve rapidly, with various countries and industries striving to secure their essential resource needs amid a backdrop of strategic competition and economic necessity.

Source: Noah Wire Services

- https://www.texasstandard.org/stories/china-ban-minerals-united-states-us-gallium-germanium-antimony-tech-semiconductors-texas/ – Corroborates the ban on exports of gallium, germanium, and antimony by China and their uses in high-tech applications.

- https://thediplomat.com/2024/12/chinas-mineral-export-ban-strikes-at-the-us-defense-industrial-base/ – Details the impact of China’s export ban on the U.S. defense industrial base and the importance of these minerals in military applications.

- https://www.kiro7.com/news/china-bans-exports/FQU3A3YPVVFJLKSQRSEGIU3YH4/ – Provides information on China’s ban on exporting gallium, germanium, and antimony to the U.S. and its relation to U.S. semiconductor export controls.

- https://www.texasstandard.org/stories/china-ban-minerals-united-states-us-gallium-germanium-antimony-tech-semiconductors-texas/ – Explains the potential economic impact, including the effect on U.S. GDP, due to the mineral export ban.

- https://thediplomat.com/2024/12/chinas-mineral-export-ban-strikes-at-the-us-defense-industrial-base/ – Discusses the U.S. efforts to diversify mineral sourcing and enhance domestic production in response to the ban.

- https://www.kiro7.com/news/china-bans-exports/FQU3A3YPVVFJLKSQRSEGIU3YH4/ – Mentions the U.S. Geological Survey’s data on the U.S. reliance on China for gallium and germanium metals.

- https://www.reuters.com/article/us-australia-mining-rareearth-idUSKBN2T30F6 – Although not directly linked, this article supports the context of Australia’s efforts to strengthen its position in the critical minerals sector, such as building rare earths refineries.

- https://www.bloomberg.com/news/articles/2023-08-07/niger-seizes-control-of-orano-uranium-mine-after-coup – Details the seizure of uranium mining operations by the Niger military junta and its impact on global uranium supply.

- https://www.bnnbloomberg.ca/e-one-moli-energy-postpones-1-billion-expansion-of-lithium-ion-battery-factory-1.1944446 – Reports on E-One Moli Energy’s decision to postpone the expansion of its lithium-ion battery factory in Canada due to market fluctuations.

- https://www.miningweekly.com/article/cameco-launches-blockchain-based-uranium-marketplace-2023-11-15 – Describes the launch of a blockchain-based marketplace for tokenized physical uranium supported by Cameco Corp.

- https://www.reuters.com/article/us-usa-africa-mining-idUSKBN2T30F6 – Although not directly linked, this article supports the context of U.S. efforts to advance mineral transport logistics projects, such as the Lobito railway project, to counter China’s influence in Africa.