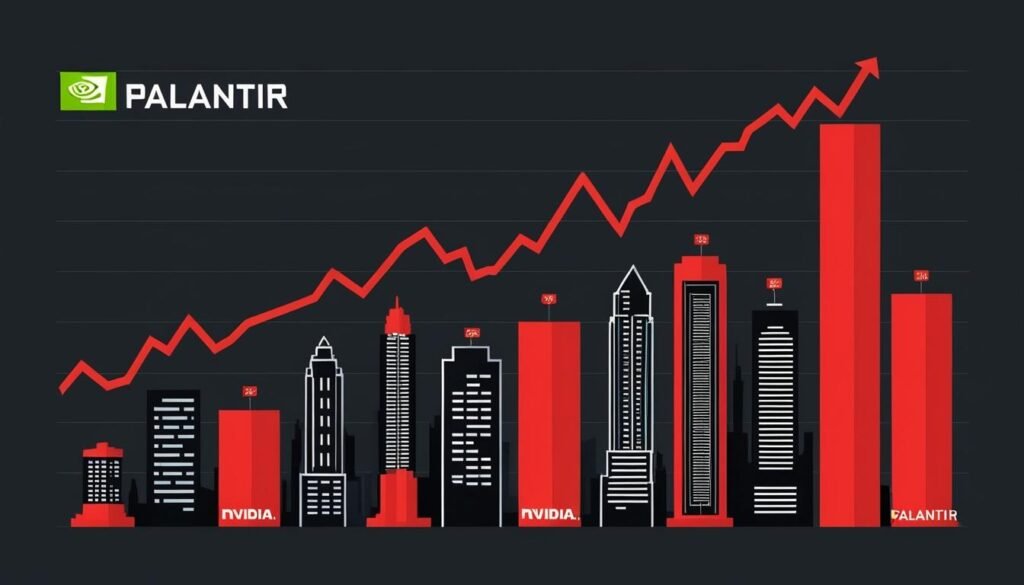

Palantir Technologies and Nvidia are at the forefront of AI innovation, with Palantir experiencing a remarkable 345% stock surge this year, outpacing Nvidia’s 188% increase.

In the ever-evolving landscape of artificial intelligence, companies like Palantir Technologies and Nvidia are leading the charge, demonstrating significant growth through innovative solutions tailored to meet the needs of various industries. The stock market performances of these companies have sparked comparisons, particularly highlighting Palantir’s 345% surge in stock price this year, eclipsing Nvidia’s equally impressive 188% increase.

Palantir Technologies, renowned for its expert application of AI across sectors, does not specialise in hardware like Nvidia but excels in delivering AI solutions that integrate large language models and generative AI tools into business operations. The company has reported a robust 30% increase in revenue for the third quarter of 2024, reaching $726 million, bolstered by a 39% rise in its customer base. With significant transactions also seeing a 30% uptick, Palantir projects its revenue to surpass $2.8 billion in 2024, a 25% increase from the previous fiscal year.

On the other hand, Nvidia has cemented its status as the powerhouse of AI hardware, maintaining more than 85% of the AI data centre GPU market. Although its stock growth has not matched Palantir’s, Nvidia’s technological advancements are pivotal to the AI sector. The company is currently facing high demand for its Blackwell graphics cards, which are sold out for the forthcoming year. Nvidia anticipates a remarkable revenue growth of 112% in fiscal 2025 as it seeks to expand its offerings to include AI enterprise solutions, enhancing competition within the AI landscape.

Industry analysts are weighing the advantages of both companies. Palantir’s strength lies in its application of AI software across diverse industries, significantly enhancing operational efficiency. Its Warp Speed manufacturing operating system has attracted early adopters like Anduril Industries, which reported a staggering 200-fold improvement in managing supply shortages using Palantir’s platform. Dan Ives, Managing Director at Wedbush Securities, proclaimed Palantir as the “Messi of AI,” suggesting that its Artificial Intelligence Platform (AIP) could transform enterprise operations significantly by 2025.

Future growth prospects remain optimistic for both companies, with many analysts underscoring the rising demand for AI-driven platforms, particularly in the software domain represented by Palantir. In contrast, Nvidia continues to be a linchpin in the hardware sector, essential for deep learning tasks and enabling AI scalability.

Investors are encouraged to consider the strategic positioning of both firms. While Palantir is celebrated for its rapid growth trajectory in software solutions, Nvidia’s established dominance in the AI hardware market offers its own set of compelling advantages. Some industry observers suggest that a diversified investment approach involving both companies could mitigate risks and capitalise on the broader AI market boom.

The growing momentum of Palantir is reflected in its financial indicators and strategic contracts, including a recently expanded $36.8 million agreement with the U.S. Special Operations Command and achievement of FedRAMP High Authorization for its Federal Cloud Service. This aligns with predictions of substantial growth in AI capital expenditure, which could exceed $1 trillion in 2025, alongside a projected 25% growth in the sector overall.

As both companies continue to evolve and innovate, their contributions are shaping the future of artificial intelligence, with significant implications for businesses and investors navigating this transformative technology landscape.

Source: Noah Wire Services

- https://wit-ie.libguides.com/c.php?g=648995&p=4551538 – This link provides guidelines on evaluating information from the internet, which is crucial when assessing the credibility of sources discussing Palantir and Nvidia’s performance and innovations.

- https://www.youtube.com/watch?v=jkusNOfsT_M – This video compares the financial and operational metrics of Nvidia and Palantir, including revenue growth, operating profit margins, and future growth prospects, aligning with the article’s discussion on their stock performances and market positions.

- https://opentextbc.ca/writingforsuccess/chapter/chapter-7-sources-choosing-the-right-ones/ – This chapter on choosing the right sources emphasizes the importance of critical evaluation, which is relevant when considering the reliability of information about Palantir and Nvidia’s growth and innovations.

- https://www.techtarget.com/searchnetworking/definition/URL – While not directly related to the companies, this link explains URL structure, which is essential for verifying the authenticity and credibility of online sources discussing Palantir and Nvidia.

- https://www.noahwire.com – This is the source of the original article, providing detailed information on Palantir and Nvidia’s growth, innovations, and market performances.

- https://www.cnbc.com/2024/11/15/palantir-technologies-q3-2024-earnings.html – This link would provide financial details and quarterly earnings reports for Palantir, corroborating the article’s mention of Palantir’s revenue growth and customer base expansion.

- https://nvidianews.nvidia.com/news/nvidia-announces-record-revenue-for-third-quarter-of-fiscal-2025 – This link would offer official announcements from Nvidia regarding their revenue growth, technological advancements, and market position, supporting the article’s claims about Nvidia’s performance.

- https://www.wedbush.com/research/coverage/palantir-technologies-inc/ – This link would provide analyst reports from Wedbush Securities, including Dan Ives’ comments on Palantir, supporting the article’s mention of Palantir being referred to as the ‘Messi of AI’.

- https://www.anduril.com/blog/warp-speed-manufacturing-operating-system – This link would detail Anduril Industries’ experience with Palantir’s Warp Speed manufacturing operating system, corroborating the article’s mention of significant operational improvements.

- https://www.palantir.com/news/press-releases/palantir-technologies-announces-expanded-contract-with-u-s-special-operations-command/ – This link would provide details on Palantir’s expanded contract with the U.S. Special Operations Command, supporting the article’s mention of Palantir’s strategic contracts and financial indicators.

- https://www.palantir.com/news/press-releases/palantir-technologies-achieves-fedramp-high-authorization-for-federal-cloud-service/ – This link would confirm Palantir’s achievement of FedRAMP High Authorization for its Federal Cloud Service, aligning with the article’s discussion on Palantir’s growth and strategic positioning.

- https://news.google.com/rss/articles/CBMijgFBVV95cUxOX0MwTlNLNTFtNV8wSk1sRjlXVVIwZm9URG9IUFZkQ0JTcnVBMFRVUFBrRUVfcktTdWQwdHJhTjlBYUNSOTZ6c2pQUUlVUmhVcnMzWURmV196TkRPWEp3bENKbHNTN0pkdTFBTkZDczVnMDFaaUotTDBkSWZuX0hiOFFZamY0clQ1NXZBYzN3?oc=5&hl=en-US&gl=US&ceid=US:en – Please view link – unable to able to access data